IR35

Off-Payroll rules are changing from 6th April 2021. This means that the determination of the IR35 status of a contractor is being moved from the contractor to the client who engages the contractor for assignments.

What is IR35?

IR35 is the common name given to the Intermediaries Legislation which came into force in April 2000 and is HMRC’s “test” for self-employment for tax purposes only when a contractor is working through their Personal Services Company (PSC). The legislation distinguishes between a genuine self-employed contractor working via their PSC and those who work via their PSC but whose working practices would suggest they operate more like an employee (who HMRC call a “disguised employee” and would fall inside IR35). If you are a genuine self-employed contractor (so outside of IR35) then you usually receive gross payments for your services via your PSC allowing you to pay some of your income in dividends, which in turn creates a tax benefit. Working via a PSC will also reduce the amount of National Insurance payable. The “Disguised Employee” should pay broadly the same amount of tax and NI as an equivalent employee would.

How is IR35 determined?

Currently the contractor will state their determination to the agency or engager when they start an assignment and do not need to show proof of their status. The simplest way to determine IR35 is to apply employment tests to determine an outcome. However, these employment tests have not been included in the regulation itself, therefore decades of employment case law are needed to be understood and applied. This provides plenty of grey areas and can be very subjective. However, the 4 most influential tests or factors to determine the IR35 status are –

- Substitution

- Supervision, Direction and Control

- Financial Risk

- Mutuality of Obligation

There are 2 ways to take these tests as a contractor or an engager – use HMRC’s CEST (Check Employment Status for Tax) or utilise a 3rd party to manage these employments tests for you.

Why the changes?

The basic driving force for the changes to IR35 is that HMRC has realised it is missing out on a huge amount of taxable income from contractors (especially Employers NIC). HMRC does not have a strong history of winning IR35 legal cases, so to assist them in accessing this extra tax income and to “improve the compliance” around contracting in the UK, HMRC has shifted the emphasis of the decision making on the contractor’s taxation away from the often, single person Ltd companies onto the larger business engagers who use these contractors. HMRC knows that by getting the larger businesses involved via a change in legislation, there will be a more stringent approach to the contractors IR35 status, therefore more “Disguised Employees” will be identified and taxation will rise. It is a simpler, self-regulated formula for HMRC, which they claim saw an estimated additional £550 million in Income Tax and National Insurance contributions raised in the first 12 months from rolling this legislation out in the public sector. HMRC had forecasted an increase of £1.165 billion in 2020-2021, £595 million 2021-2022, £635 million 2022-2023 and £725 million 2023-2024 if the new legislation hit the private sector in 2020.

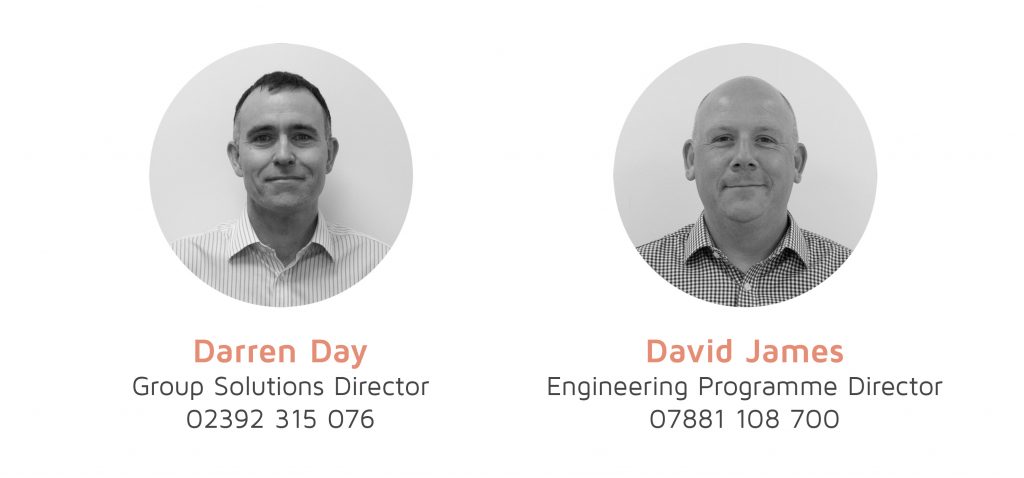

How can Stride help?

Stride provides a range of solutions dependant on your specific need and the resources you have at your own disposal to manage a critical project of this nature. Our IR35 specialists provide you with an advantage that other recruitment agencies do not; our team has managed projects ranging from a small handful of contractors right through to a private sector contractor workforce of 1,500. Our scopes have covered both direct and agency contractors. This means we understand how important it is that you design and implement an IR35 strategy and procedures which are tailored to your business size, working practices and risk profile to mitigate the risk of a HMRC default and to ensure you remain competitive within your talent marketplace.

David James had a recent IR35 article published in the Aberdeen Energy Voice publication which can be seen at –

Please read though our IR35 Client Solutions document or contact us to discuss your IR35 project needs in more detail so that we may provide an appropriate solution.